Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Spectra School launches in next week or two

In a few weeks, we will be launching our flagship Spectra School course:

Think Like a Market Professional

Last chance to join the waitlist before launch to receive a major discount and other sweet treats on Day 1.

Sign up for the waitlist now, with no obligation

The Course Includes:

- 16 long-form written online lessons.

- 8 long-form “Learning from Legends” videos featuring (in alphabetical order) … well-known Wall Street experts like… Danielle DiMartino Booth, Matt Gittins, Jim Grant, Tony Greer, Ben Hunt, Leland Miller, Alf Peccatiello, and Sam Rines. (What an insane lineup!)

- 7 short-form “Behind the Screens” videos covering specific market topics.

- 2 hours per month of live discussion / AMA / Q&A with Brent Donnelly and Justin Ross.

- Online exams and certificate of completion.

https://www.spectramarkets.com/school/

Here’s what you need to know about markets and macro this week

Global Macro

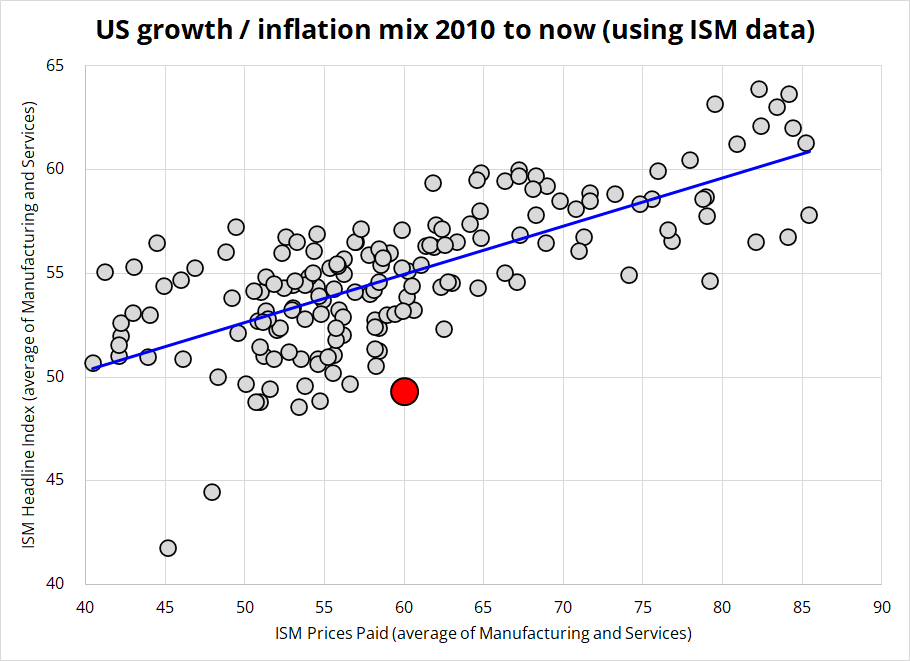

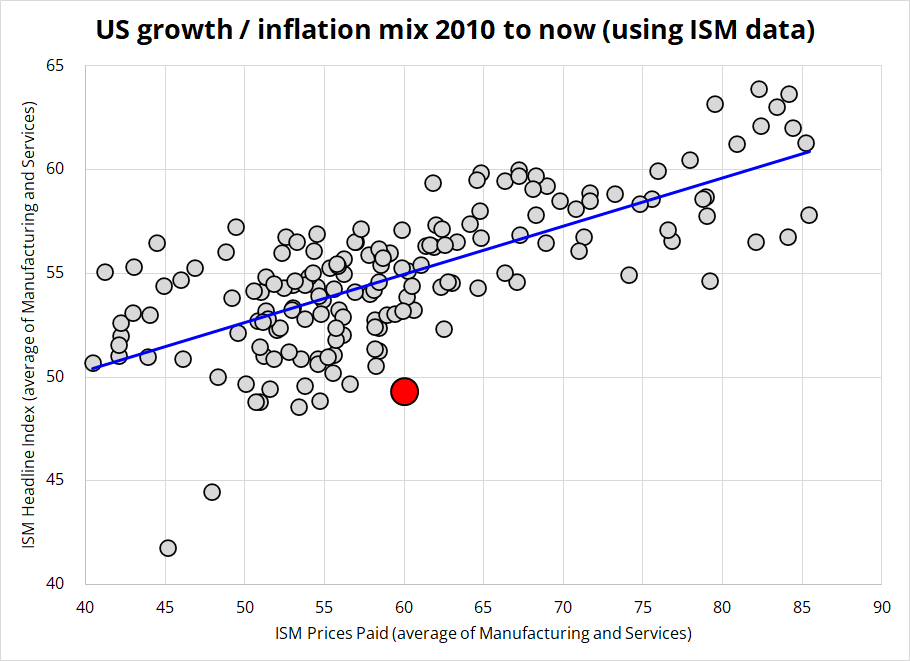

There has been a notable change in the tone of the data recently as we have moved from stonking disinflationary boom to possibly-troubling reacceleration in recent weeks and now to possibly-troubling softness on the demand side. While prices paid and employment costs continue to come in hot, it’s becoming less obvious that the US economy is all systems go.

There has been a spate of US economic warning signs of late, starting with the S&P PMI commentary on jobs a while ago, and more recently with weak GDP, weak Consumer Confidence, a stunning drop in construction job listings (JOLTS), weak Chicago, weak ISM, and stark warnings on the consumer from Amazon, Starbucks, CVS, McDonald’s, YUM, and others.

Check out the growth vs. inflation mix right now.

I have been skeptical of the soft (survey) data throughout this cycle because this cycle is different from all the other ones in our lifetime. There are four main explanations for why abysmal survey data never fed through to the hard data in 2022/2023:

- The inflation shock crushed sentiment. As Americans experienced rapidly -rising prices for the first time in their lives, they hated it. This was clear as you could see inflation-oriented surveys like Michigan were much weaker than non-inflation-oriented surveys like Conference Board Consumer Confidence. Inflation is bad for sentiment, but it’s good for nominal growth and earnings. So it can smoke the survey data but leave the hard data unharmed. As inflation came off, these surveys stabilized and there is quite a lot of evidence that inflation was a prominent driver of low consumer confidence.

- Rising rates put fear into the hearts of business operators. Economists were mostly calling for an imminent recession throughout 2022 and 2023. That bearish outlook from forecasters was reflected in a bearish outlook from business leaders.

- Business leaders mostly vote Republican and are disillusioned by three years of a Democratic rule.

- Negativity bias is getting worse and worse in financial and all media.

The first two should have much less impact now, even as inflation blips a bit higher again in the US. Number three should be dissipating as red voters’ hopes rise with an election on the horizon. Four is never going to change.

So, could it be that with real wages stabilizing and interest rates no longer rising, the driver of the weak data is falling demand or truly falling economic confidence for the individuals and businesses surveyed? I think that’s a reasonable thesis.

I have so far avoided the trap of looking at secondary data while ignoring the primary, perennially useful US economic data in order to confirmation bias my way to a bearish outlook for the economy. The workhorse hard data (Claims, Retail Sales, NFP, and GDP) has been consistently strong for almost two years but now you have Retail Sales and GDP rolling over a bit, and a flurry of corporate warnings on the consumer. It’s time to be on high alert for a turn in NFP and Claims. The US consumer might be softening but it’s way too early to say so for sure. Today’s NFP might be the first step towards a softer labor market.

I’m not calling recession here, just saying that relative to rates markets which were priced for perfection, there could be a soft patch coming that derails the bond shorts and the dollar longs.

Here’s a 50,000-foot view of how the data has evolved post-COVID. The numbers tell you the ranking of the data point over the prior 5 years. That is: “1” is the strongest in past 60 months. “60” is weakest. The chart reminds me of fruit salad. Yummy yummy.

Stocks

Equity markets have been like  this year as investors piled in at the March highs and then had second thoughts as inflation surged and the Fed cut mania subsided. As we moved from 6 cuts to 3, the market stayed complacent, but as the probabilistic pricing got closer to 1.5 cuts and the modal outcome got to zero, the market struggled. This was true of all the risky debasement assets, not just stocks. Gold, silver, bitcoin, and every other debasement hedge ripped for most of Q1 as the view was the Fed will cut no matter what.

this year as investors piled in at the March highs and then had second thoughts as inflation surged and the Fed cut mania subsided. As we moved from 6 cuts to 3, the market stayed complacent, but as the probabilistic pricing got closer to 1.5 cuts and the modal outcome got to zero, the market struggled. This was true of all the risky debasement assets, not just stocks. Gold, silver, bitcoin, and every other debasement hedge ripped for most of Q1 as the view was the Fed will cut no matter what.

Once that assumption unraveled on persistently strong data, the risky asset bonanza cooled. Still, buybacks, a dovish Fed, and much lower fixed income volatility have allowed stonks to maintain a decent bid. While today’s NFP is fun to talk about, and the Fed meetings make great theatre… The only thing that truly matters right now is the trajectory of inflation.

We did get some concering data on prices this week with the Employment Cost Index hot and Prices Paid zooming back up in the ISM survey, but my view is that this is a backward-looking vibe and peak reflation arrived around April 1st. Since then, commodities have reversed aggressively. Oil dropped 10 bucks to $78, copper is swooning, Cocoa’s collapsing, and lumber is plunging.

It’s also worth noting that 0.6% of the current 3.8% core CPI reading comes from auto insurance and yesterday Allstate said no mas. Here’s the info via a tweet from VKM.

The most interesting data point we saw on Thurs: ALL (Allstate) said that two years of aggressive price hikes (’22 and ’23) means that the portion of auto premiums earning adequate returns currently stands at 64%, up from 34% in ’23 and just 8% in ’22. The implication of this is that price increases should cool considerably going forward and in fact mgmt. talked about how they are pivoting back to policy growth after focusing on margins and profitability over the last two years.

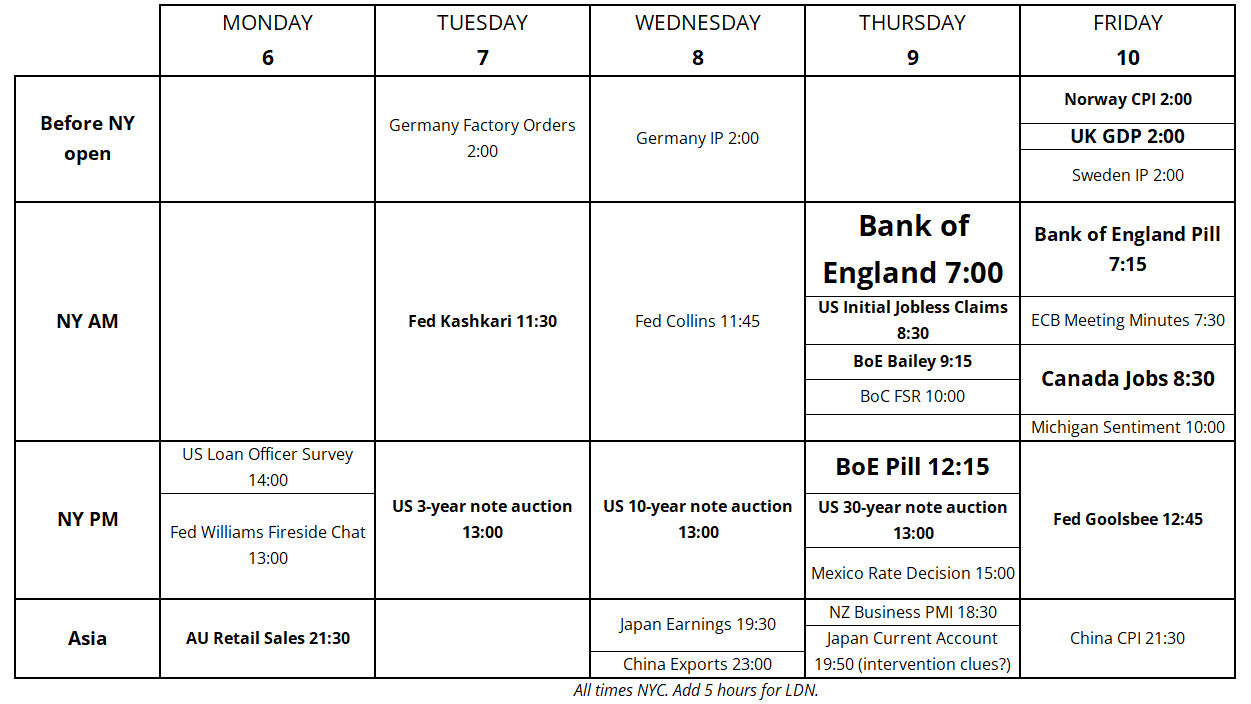

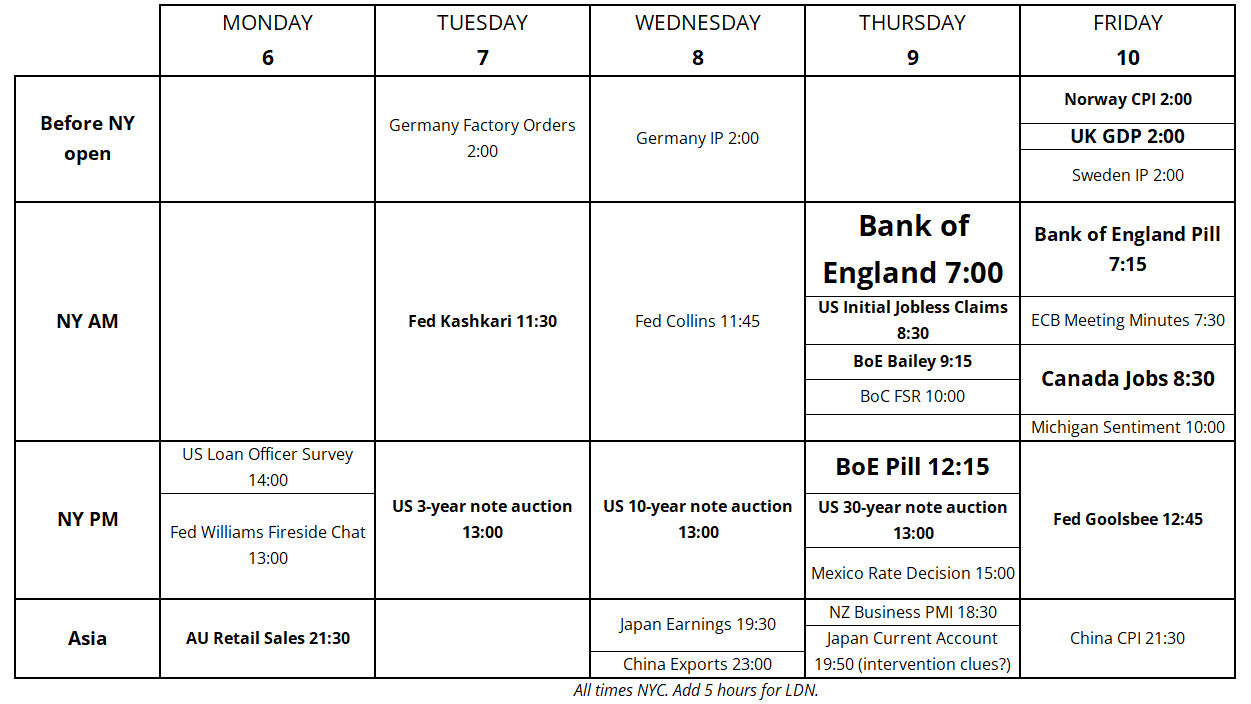

Modestly slower demand and lower inflation would be great for stocks but we need to wait a while for that (if it’s gonna happen) because CPI and PCE are scheduled for 15MAY and 31MAY respectively. Speaking of calendars, here’s the agenda for next week:

National Association of Securities Dealers Automated Quotations

The NASDAQ futures chart is interesting as we’re bumping up against important resistance at 18050. I have oft written about how old support becomes important resistance and this is one of those times. A daily close above 18050 would signal that the choppy toppy action could be done and a renewed assault on the ATH is imminent. If you’re bearish, it’s a nice pivot as you can get decent leverage shorting here with a stop above 18,100. Not trading advice.

Here is this week’s 14-word stock market summary:

The NASDAQ is sharply unchanged, despite a 500-plus point range. Watch 18050 pivot.

Interest Rates

If you care about bonds and interest rates, you need to have a framework that weighs various drivers somewhat correctly. The three main things you care about, depending on what part of the curve you’re look at are:

- Fed policy, Fed reaction function, and Fed bias.

- Growth and inflation.

- Risk premium (credit / default / devaluation / bond vigilante risk).

Forgetting about number three for today, I think growth and inflation are much, much more important than Fed communications right now because the Fed is all over the place. They have ditched the forecasting approach that has driven policy through most of my lifetime and moved to a data-dependent approach.

This sounds logical, but it’s not, really. Policy acts with long and variable lags and data is noisy. If you’re using 3-month annualized figures to set policy communications, you’re going to need a nice pair of flip flops. If you’re going to have 18 people on CNBC every three days freestyling views about fast-changing, noisy data subject to multiple interpretations… You’re going to get a bit of a clown show.

There has been no shortage of clownshow moments for the Fed during Powell’s tenure, most notably:

- “We are a long way from neutral” in 2018. That was the high in yields.

- 2019 framework review and introduction of FAIT to let inflation “run hot” right before the biggest inflation explosion in decades.

- “Inflation is transitory.” Continuing to stay loose and buy assets into 2022, goosing a prolonged 2-year inflation surge that led to 500 bps of hikes.

- Top Fed officials resign after trading their own investment accounts around Fed announcements while America was locked down under the cloud of COVID.

- Failure to understand, oversee, and properly regulate Silvergate.

- Pre-announcing rate cuts in late 2023 despite inflation well above target, triggering a rebound in animal spirits and inflation.

Grammarians please note: I have decided that a “clown show” (noun) is two words, but when using clown show as an adjective (i.e., “clownshow moment”) it should be one word. Online there’s a dictionary that says clownshow is only a noun, and it’s one word. I politely disagree.

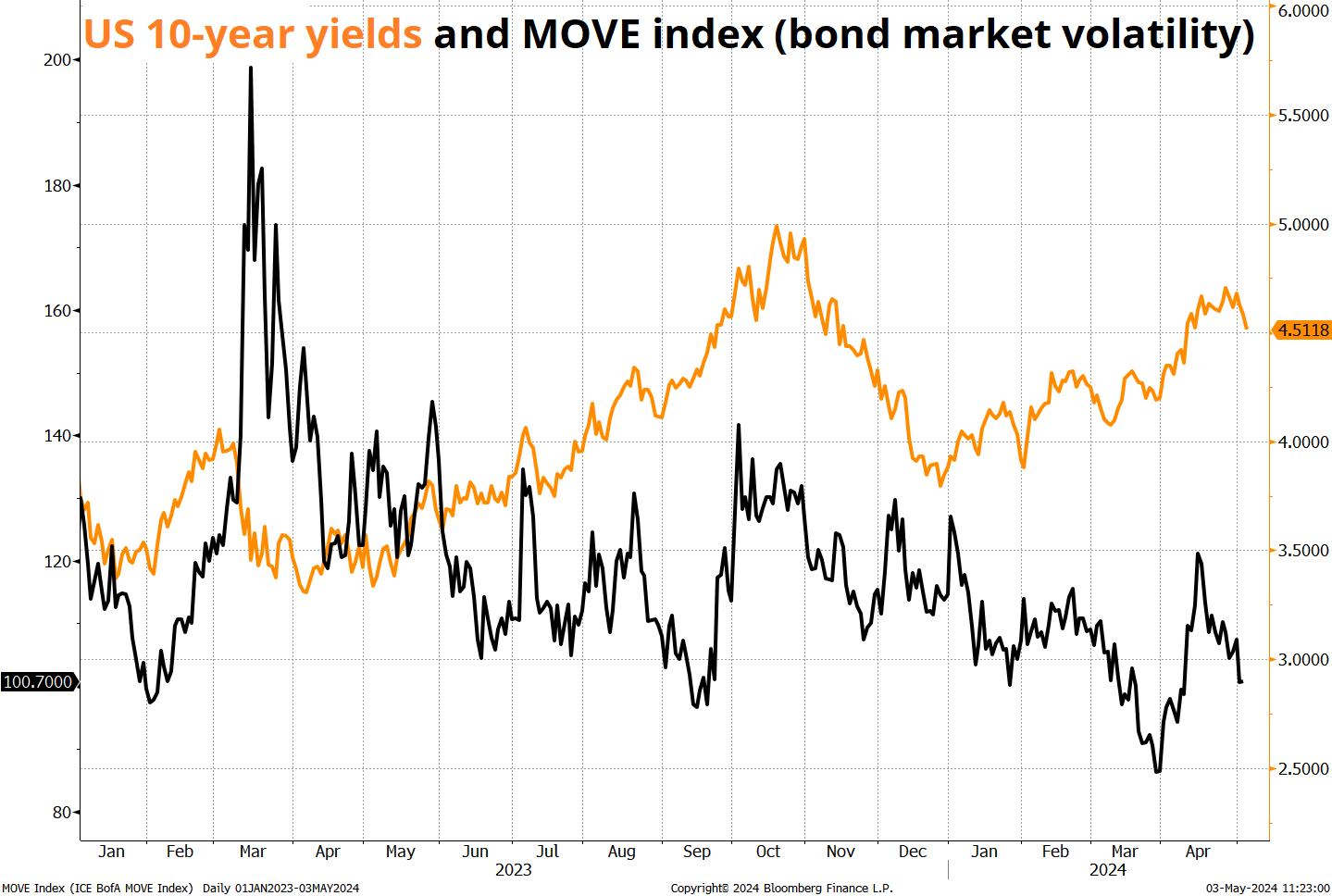

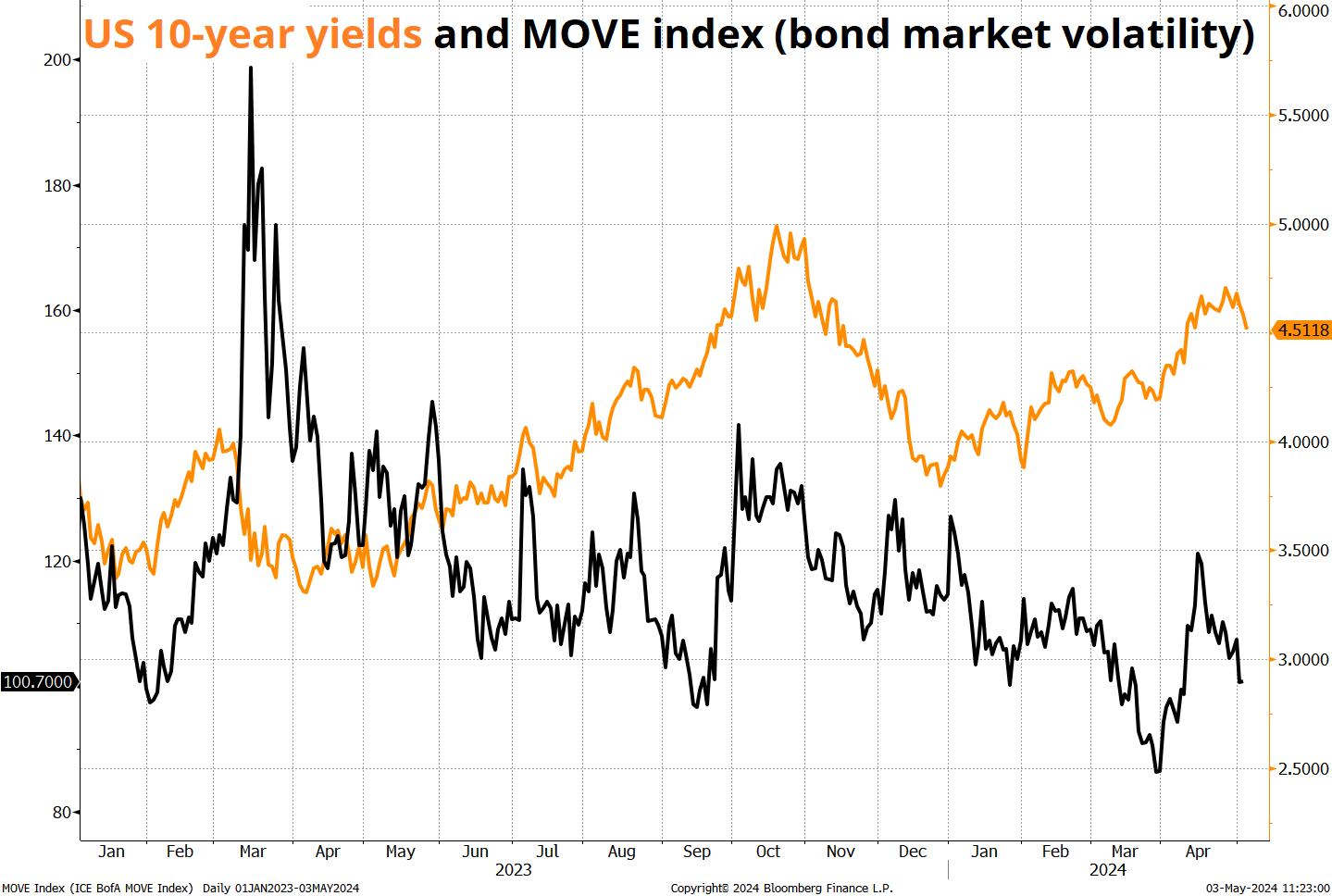

Despite the recent rise in yields, bond market volatility has been unscary. You can see the strong correlation between higher yields and higher vol in the next chart but also note how vol is making a steady series of lower lows. Once the Fed truncated the rate hike side of the distribution, panic subsided.

I suppose I should talk about the Fed meeting in here, but you probably read about it already and I think these meetings are mostly a combination of Kabuki theatre and Kayfabe right now.

Fiat Currencies

The big stories in FX have been the huge long USD position built up in recent weeks, and the panic over the JPY.

Here’s what I wrote on Monday, when people were straight up freaking out about the yen.

Excerpted from am/FX: Is this a currency crisis?

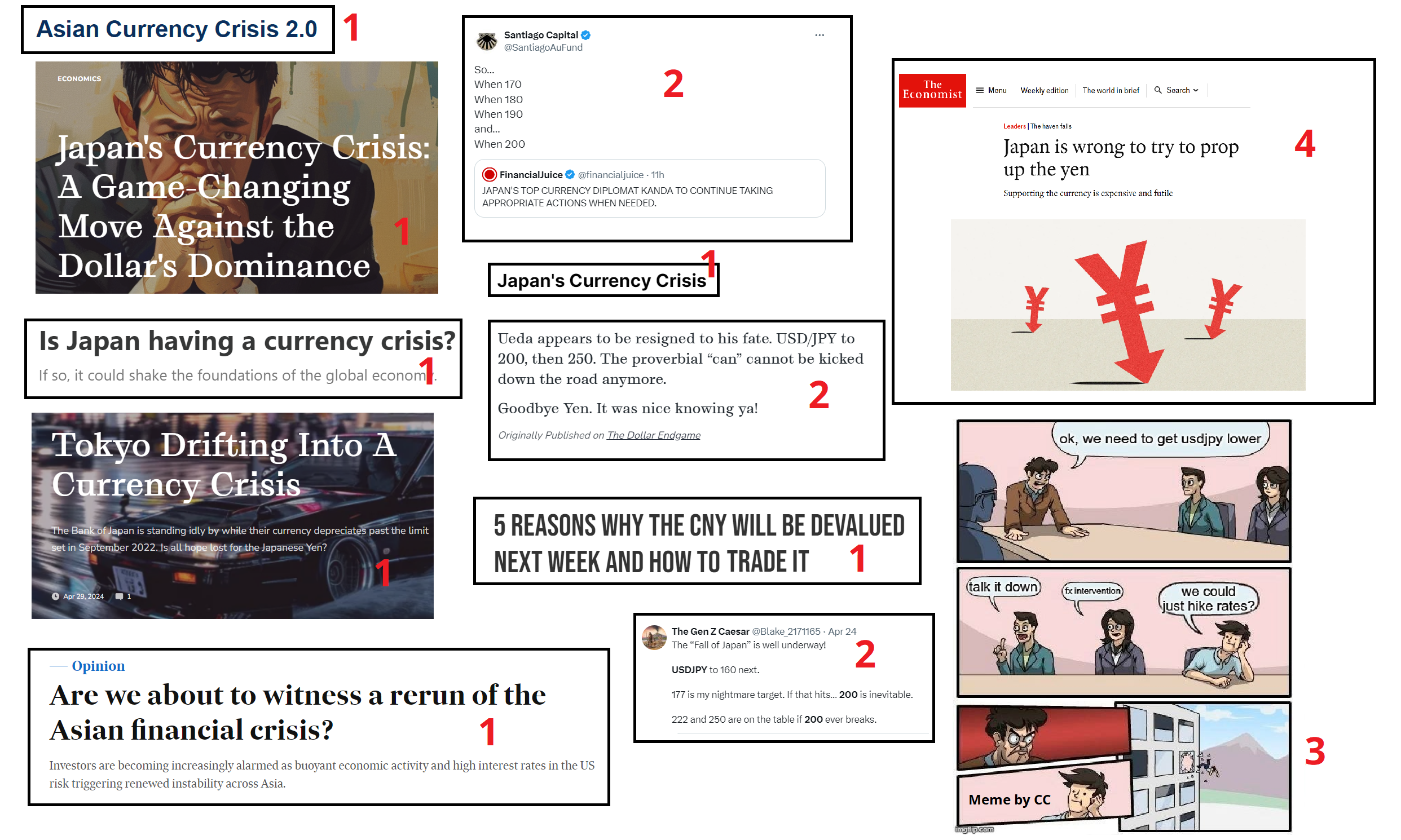

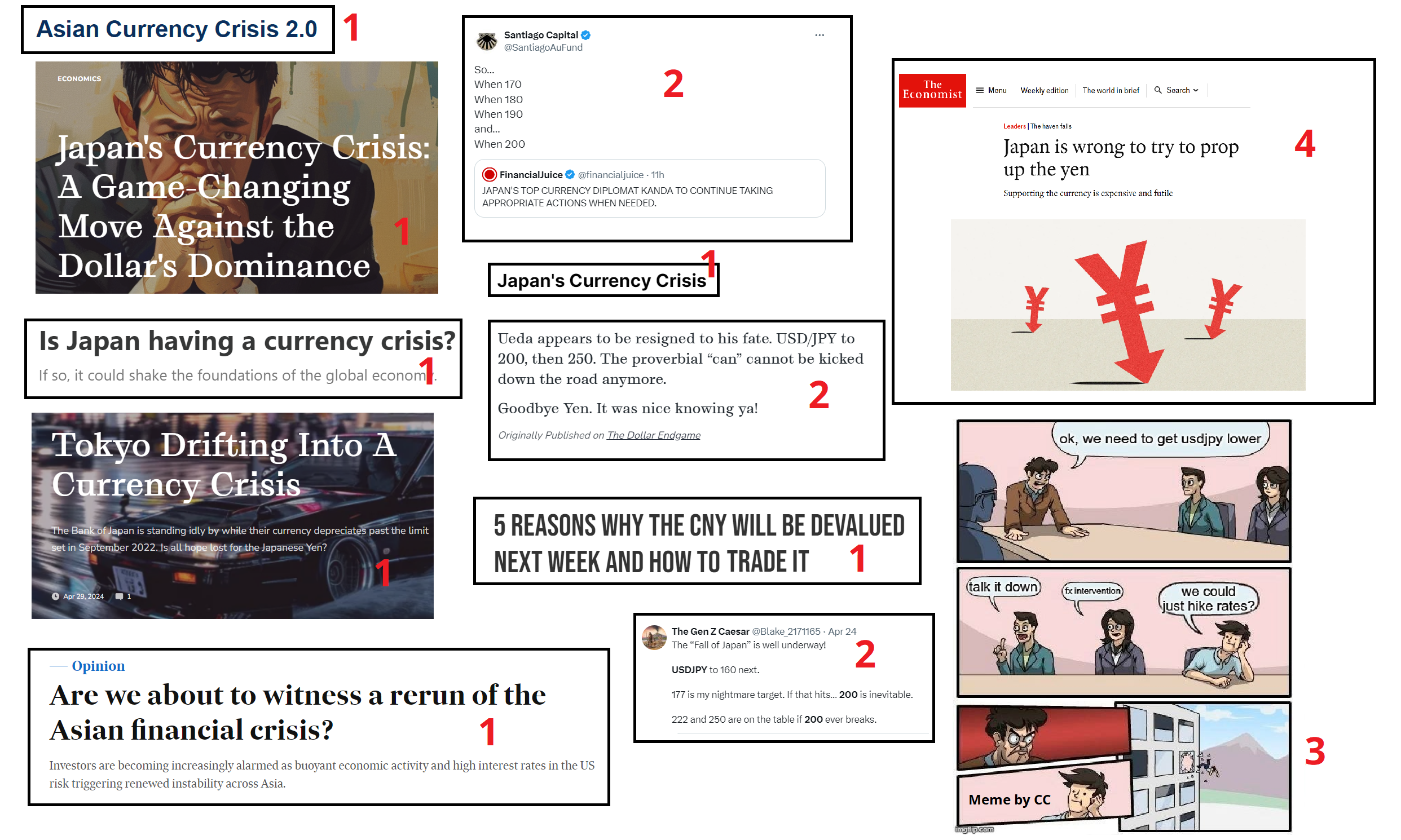

A comical but accurate law that is not actually a law is: Betteridge’s Law. It’s a useful heuristic when consuming financial media because the best way to put forth a visceral clickbait headline that is intentionally sensational is to simply pose a question. Here’s the full definition from Wikipedia:

Betteridge’s law of headlines is an adage that states: “Any headline that ends in a question mark can be answered by the word no.” It is named after Ian Betteridge, a British technology journalist who wrote about it in 2009, although the principle is much older. It is based on the assumption that if the publishers were confident that the answer was yes, they would have presented it as an assertion; by presenting it as a question, they are not accountable for whether it is correct or not.

It came to mind as the AFR ran this:

And Noah Smith ran this:

Is Japan facing an awkward situation after intentionally devaluing its currency from 75 to 160? Yes. Are they showing a new generation of economics students how the trilemma works? Yes. Is it a currency crisis? No.

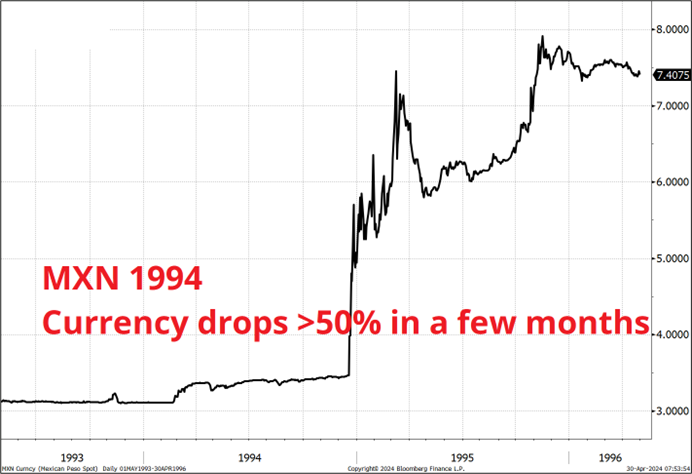

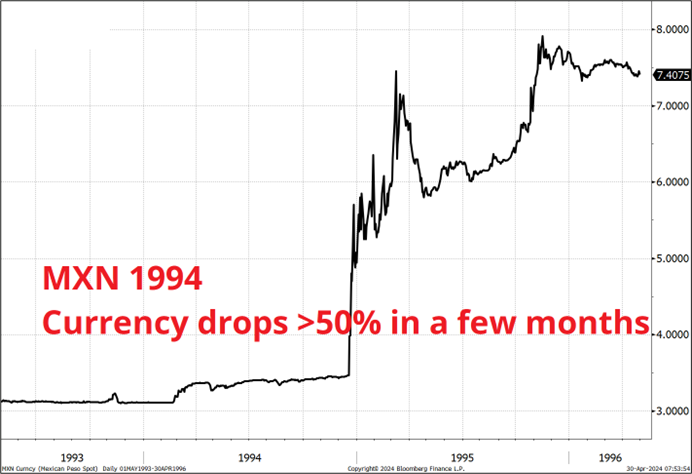

For context, here’s what a currency crisis looks like. A 50% drop in the currency in 6 months, and 10% inflation YoY in Thailand in 1997. A 50% drop in the currency in a few months, and 50% YoY inflation in Mexico in 1994.

The JPY has dropped 6% in the past 6 months and Tokyo YoY inflation just clocked in at 1.8%.

I am still skeptical of any sort of out-of-control collapse of the yen. The trilemma issue is that the BOJ is loose and therefore the currency must depreciate. That’s fine.

All the MOF can do is buy time and hope for lower US yields. The 2-year rate differential between the US and Japan is nowhere close to the all-time extreme. So yes, the trilemma is in play here, especially with YCC adding to the story, but it’s not like we are in unprecedented territory.

Meanwhile, if you are into behavioral finance, we have now ticked all four boxes you see at the extremes.

- Crisis language and doom and gloomers getting busy

- Wild, extrapolation-style price targets.

- Memes.

- The Economist enters the fray.

All those headlines and images are from the last 7 days. None of this means that USDJPY needs to peak right here, but they are clear signs that we are now in the hysterical phase.

End of excerpt.

That day was the high in USDJPY. Behavioral clues can be useful when attempting to assess the extremes in markets. Spotting behavioral and narrative extremes is one of the grillion+ frameworks you will pick up in our upcoming course “Think Like a Market Professional” when it launches in a few weeks.

Sign up for the wait list here and receive a meaningful discount on launch day.

Crypto

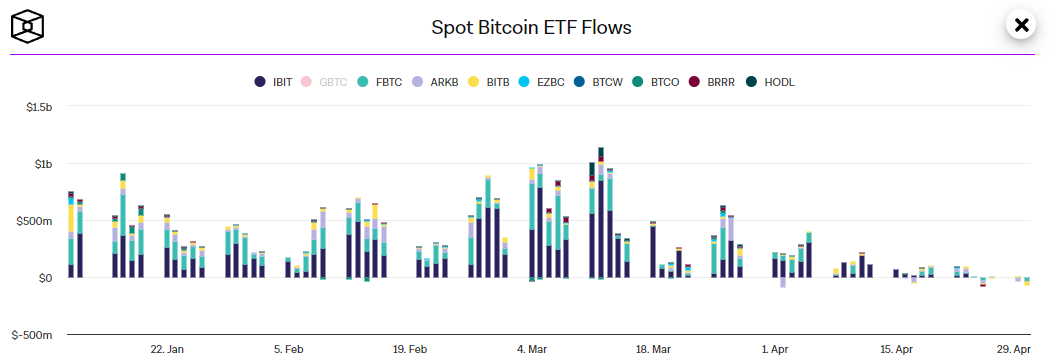

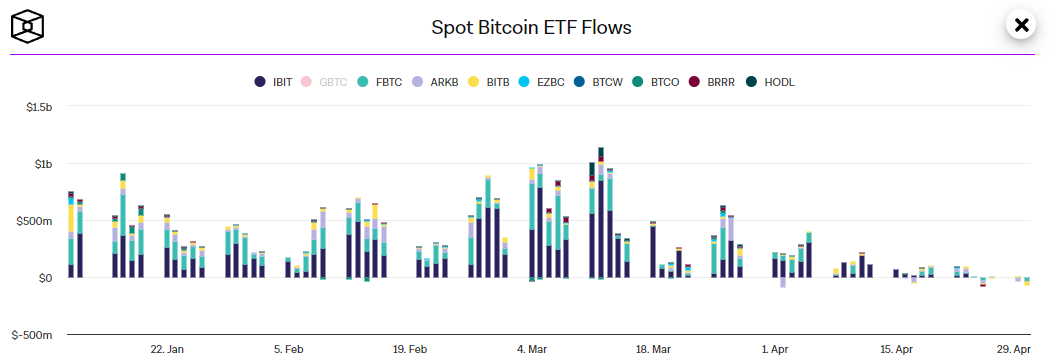

It is no coincidence that bitcoin ETF flows dried up at the same time as the NASDAQ peaked. While the narratives surrounding the two securities are wildly different, their price behavior is similar. This next chart shows ETF flows into bitcoin, but excludes GBTC flows, because they are not representative of anything other than an idiosyncratic story. You can see the flows started strong when the ETFs launched, and got stronger, eventually peaking (along with price of course) in mid-March.

I find it interesting that WIF is holding in so well, as it outperforms both BTC and DOGE on this bounce. Perhaps long-term investors are betting on a rising probability of a global WIF-coin standard, in contrast to lower odds of a world where all entities transact globally in DOGE. Or maybe WIF is funnier, and DOGE is old news. Memecoins are mostly about self-aware fools buying lottery tickets they hope to sell to greater, less self-aware fools. Once a memecoin’s volatility falls, it becomes less fun to trade and thus becomes worth relatively less in the market. Volatility and convexity are the two main use cases for memecoins.

For the record, I believe that BTC, WIF, DOGE, and CNH all have about an equal chance of replacing the dollar as the dominant global reserve currency by 2050.

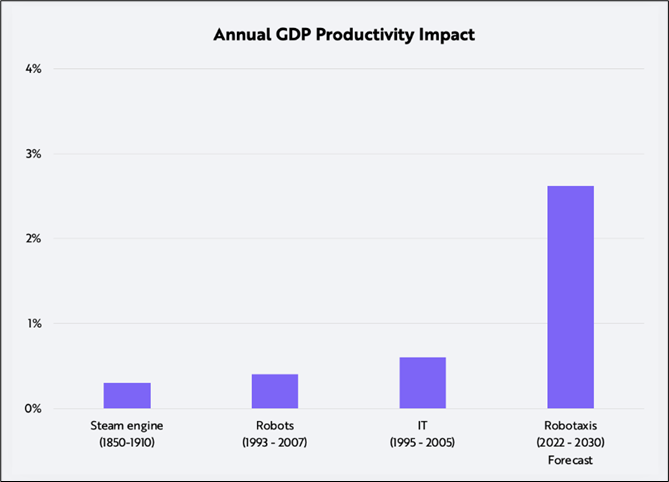

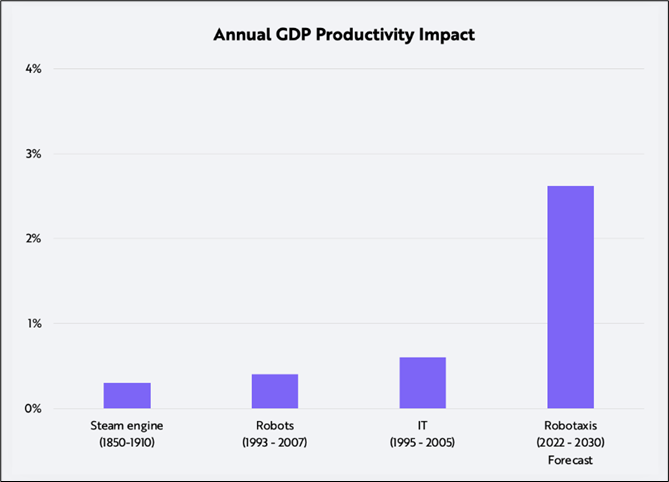

Speaking of stupid predictions! I very rarely speak negatively about others in the industry because I think it’s not very nice and because I make bad forecasts and chuck up airballs all the time. That said, there is one company that uses ridiculous forecasts to get media attention and trigger FOMO in the nether regions of unsophisticated investors and I am willing to call that out for what it is.

Exhibit #384

Yes. OK. Cheers.

Commodities

Commodities look a bit troubled. If you follow my stuff, you know I have been talking about Dr. Copper in am/FX and on the podcast. The metal has been rallying like the Energizer bunny, but copper could be putting in a top here. By the way, it really irks me that the symbol for COMEX copper on Bloomberg is HG, but that’s the periodic table for Mercury. What the hell? Where is the outrage???

Elsewhere, the Krakatoa formation in cocoa continues to play out, oil trades soggy, gasoline prices are lower, lumber go timber, silver and gold mania peaked, and the Bloomberg Commodity Index looks like this:

BCOM is not collapsing, but it is telling me that the time to freak out about inflation and sell bonds and buy dollars was two months ago, not now. The data we’ve seen this week showing higher prices are reflecting the surge in commodities from February to April and that surge has now run its course.

Again, I’m not expecting a dirtnap. I just think we are seeing signs of slowing demand and most real-time factors point to lower prices in Q2, not higher.

This is an ad.

I hope you make my podcast with Alfonso Peccatiello part of your weekend routine. Here is the link. This week we discuss how nominal growth is showing early signs of fatigue, while economists’ expectations remain elevated and market pricing still quite hawkish.

OK! That was 10.4 minutes. Sometimes I can’t control how long this thing is—it just flies out of my fingers like a spell. I’ll make it shorter next week, though, I promise. If you noticed the oblique reference to two battery companies in this week’s Speedrun, email me the full corporate names of both manufacturers. I’ll send a signed copy of Alpha Trader to the first correct answer.

Get rich or have fun trying.

Links of the week

Join the waitlist for Spectra School. Let’s go! Improve your thinking and learn the right frameworks for trading and investing. The stuff you don’t learn in college. https://www.spectramarkets.com/school/

Smart, interesting, or funny

- The Hero’s Journey is a Jammed Door

The hero’s journey has become less accessible in the age of late capitalism and so we need to live it vicariously through formulaic pop culture. People feel less and less able to reach adulthood.

- Why I don’t invest in real estate by Tomas Pueyo

Most people, including me, just kind of assume real estate will go up forever. Maybe it won’t?

- Often it’s not what happens, it’s how you react to what happens.

Music

If Korn wrote “MMMBOP” by Hansen

If you like this, check out some of his work. A talented man!

HT JR. Whenever I think of MMMBOP I think of this t-shirt.

this year as investors piled in at the March highs and then had second thoughts as inflation surged and the Fed cut mania subsided. As we moved from 6 cuts to 3, the market stayed complacent, but as the probabilistic pricing got closer to 1.5 cuts and the modal outcome got to zero, the market struggled. This was true of all the risky debasement assets, not just stocks. Gold, silver, bitcoin, and every other debasement hedge ripped for most of Q1 as the view was the Fed will cut no matter what.

this year as investors piled in at the March highs and then had second thoughts as inflation surged and the Fed cut mania subsided. As we moved from 6 cuts to 3, the market stayed complacent, but as the probabilistic pricing got closer to 1.5 cuts and the modal outcome got to zero, the market struggled. This was true of all the risky debasement assets, not just stocks. Gold, silver, bitcoin, and every other debasement hedge ripped for most of Q1 as the view was the Fed will cut no matter what.